The Harmonized Tariff Schedule of the United States (HTSUS) is compiled and published by the U.S. International Trade Commission (USITC), with regulatory interpretation and enforcement delegated to U.S. Customs and Border Protection (CBP). It is important to note that trade control measures administered by executive agencies—including embargoes, anti-dumping duties, countervailing duties, and other specific trade remedies—constitute a separate regulatory framework and are not integrated into the HTSUS. However, tariffs specifically imposed on Chinese products under Section 301 can be referenced within the HTSUS.

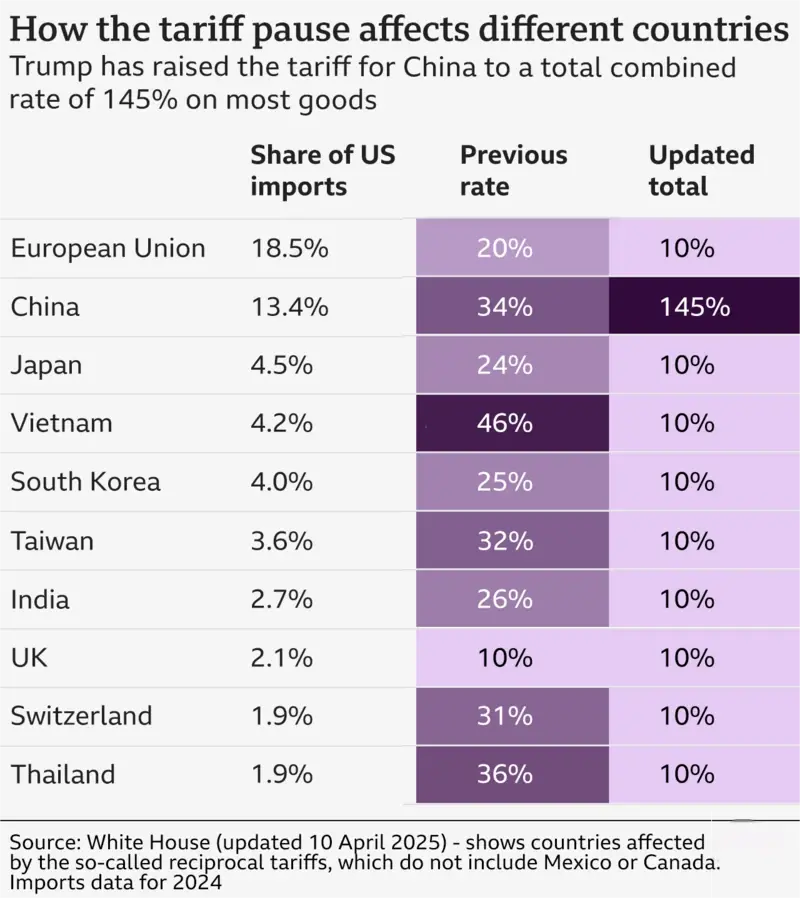

Executive Order “Modifying Reciprocal Tariff Rates to Reflect Trading Partner Retaliation and Alignment” of April 9, 2025, increases the rate of additional duties for the People’s Republic of China from 84% to 125% and suspends the country-specific rates of duty, except for 9903.01.63, until July 9, 2025. Learn more

Importers are legally obligated to classify goods under the correct HTSUS provisions prior to entry into the United States. This classification process requires adherence to a three-tiered analytical framework:

Application of the General Rules of Interpretation (GRIs);

Consideration of statutory annotations at the section, chapter, and subheading levels;

Integration of the Explanatory Notes to the Harmonized System.

The HTSUS adopts a hierarchical classification structure, extending from the World Customs Organization’s Harmonized Commodity Description and Coding System (HS). Key structural elements include:

4-digit and 6-digit codes aligning with HS international standards;

8-digit codes designating unique U.S. tariff lines;

10-digit codes for non-legal statistical reporting.

Classification under this system follows a tiered analytical approach: practitioners must first identify the most specific 4-digit provision applicable to the goods, then progressively apply subcategory rules while incorporating supplemental interpretive regulations established by the United States.

What is a Container YardSeptember 1, 2025What Is a Container Yard (CY)?A Container Yard (CY) is a designated facility within a port, inland terminal, or logistics hub where shipping containers are stored, received, and delivered. It serves a...view

What is a Container YardSeptember 1, 2025What Is a Container Yard (CY)?A Container Yard (CY) is a designated facility within a port, inland terminal, or logistics hub where shipping containers are stored, received, and delivered. It serves a...view What Is an Inspection Certificate?October 30, 2025An Inspection Certificate is an official document issued by an independent inspection agency, quality control company, or sometimes a government authority, confirming that goods have been inspected an...view

What Is an Inspection Certificate?October 30, 2025An Inspection Certificate is an official document issued by an independent inspection agency, quality control company, or sometimes a government authority, confirming that goods have been inspected an...view_400x400.webp) What Are Countervailing Duties (CVDs)?October 30, 2025Countervailing Duties (CVDs) are tariffs imposed by an importing country to offset the effects of subsidies provided by foreign governments to their exporters. These duties are designed to create a le...view

What Are Countervailing Duties (CVDs)?October 30, 2025Countervailing Duties (CVDs) are tariffs imposed by an importing country to offset the effects of subsidies provided by foreign governments to their exporters. These duties are designed to create a le...view Best 10 China Wholesale Websites That You Should Know AboutMay 30, 2025Why Source from China?China has long been recognized as the world's manufacturing hub, offering a vast array of products at competitive prices. For businesses looking to source products in bulk, China...view

Best 10 China Wholesale Websites That You Should Know AboutMay 30, 2025Why Source from China?China has long been recognized as the world's manufacturing hub, offering a vast array of products at competitive prices. For businesses looking to source products in bulk, China...view