Successfully to import products into the USA is a complex multi-step process. Customs clearance is very important part of process. When we comes to customs clearance, we have to refer to bonds. Customs bonds are required for almost all commercial imports. Customs bonds? What is it? Why do I need it? How can I get it? Today, we will talk about U.S customs bonds in depth.

What is Customs Bond?

Customs Bonds are required for a wide range of transactions and activities, and are the primary tool used by U.S. Customs and Border Protection(CBP) to safeguard the revenue of the United States and ensure compliance with applicable laws and regulations. It can simply be seen as a legal contract between an importer and U.S. CBP, ensuring that all taxes and duties owed on a shipment are paid. U.S. customs bonds are also commonly known as:

Import Bonds

Customs Entry Bond

Customs Surety Bonds

Activity code 1 Bonds(C1 Bonds)

The two types of activity code 1 bonds used by importers are known as Single Entry Bonds and Continuous Bonds. And C1 bonds is one of the widely been used bonds for commercials.

What is a Single Entry Bond?

A single entry bond is a type of customs bond which is best suited for you needing only to import a single shipment at a specific port of entry. It works very well if you occasionally import goods that have a low cost value.

If you are shipping your imports by sea, you will be required to obtain additional bond coverage to meet ISF requirements. (ISF Bond)

What is a Continuous Customs Bond?

A Continuous Customs Bond covers all of an importer’s shipments at all U.S. ports of entry for a calendar year. So, we usually call it annual bond.

Continuous bonds are best suited for importers that plan on importing multiple shipments, or using multiple ports of entry, over a 12-month period.

It’s worth noting that a continuous customs bond will also cover ISF bond requirements when shipping goods by sea.

What Does a Customs Bond Cover?

A Customs Bond acts as a financial guarantee of any fees(including taxes, duties, and fines) owed to CBP on a shipment into the USA.

The amount that a bond covers is relative to the size of bond needed for the fees owed on the imported goods. Typically, the bond amount is at least 10 percent of the total duties and fees paid to the CBP. As a benchmark, this total is usually $50,000 at the minimum.

Importers qualify to purchase a $50K bond if their duties, taxes, and fees paid to the CBP over the previous 12 months were less than $500K. New Importers can also purchase a $50K bond without a 12-month history, based on the assumption that their first-year duties, etc. will be less that $500,000.

Once your annual duties, taxes and fees meet or exceed $500K, you must purchase a larger bond amount. Continuous Customs Bond amounts are calculated based on 10% of the total duties, taxes, and fees an importer paid over the previous 12 months, in $10K increments up to $100K, and in $100K increments thereafter, as follow:

When Do I Need a Customs Bond?

Think of a customs bond as the ticket you pay for your goods to gain entry to the United States. Before you purchase that bond, your imported goods will be held at customs pending approval until you show proof of that bond. You need the bond to gain final approval to release your goods.

As single entry bonds can be approved with 48H, you can apply it during shipping. While if you need continuous bonds, please apply it ahead a few working day.

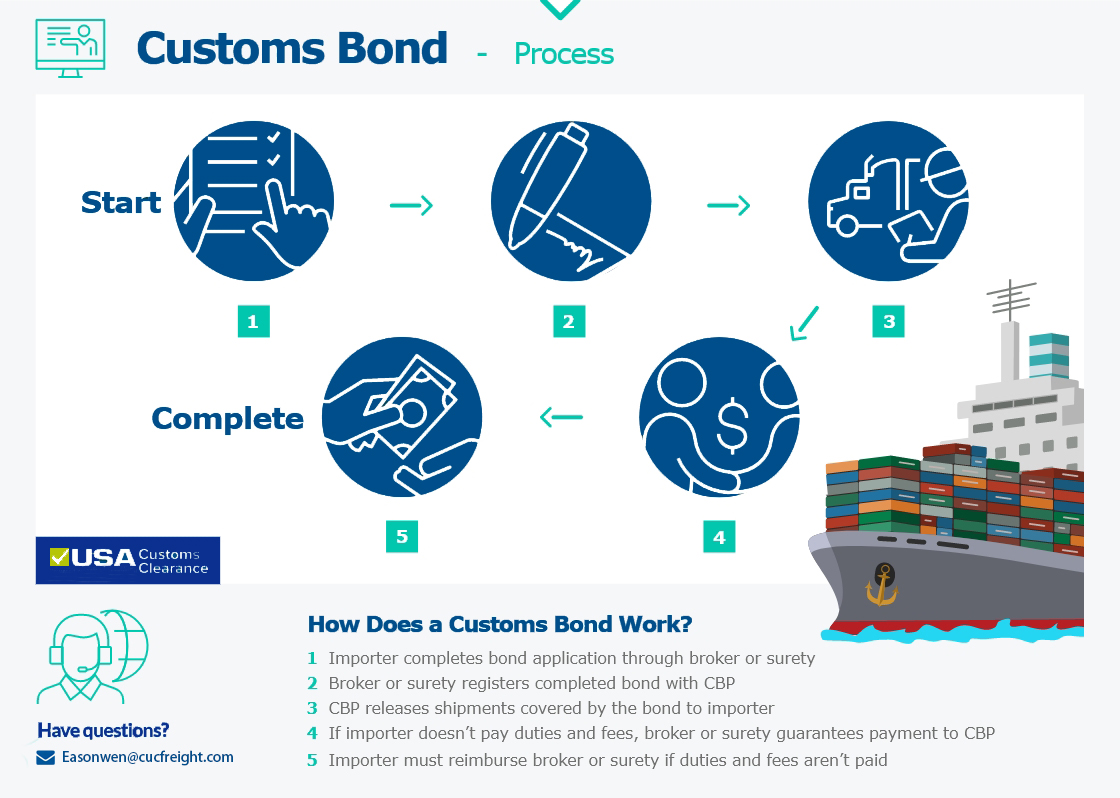

How Do I Get a Customs Bond?

Usually, Customs bonds are obtained through a Licensed Customs Broker who works with surety agencies on behalf of importer. This is beneficial to the importer because a Customs broker has the expertise and relationships related to Customs activity, and can better assist in proactively monitoring the bond and also with resolution of any issues or claims that may arise.

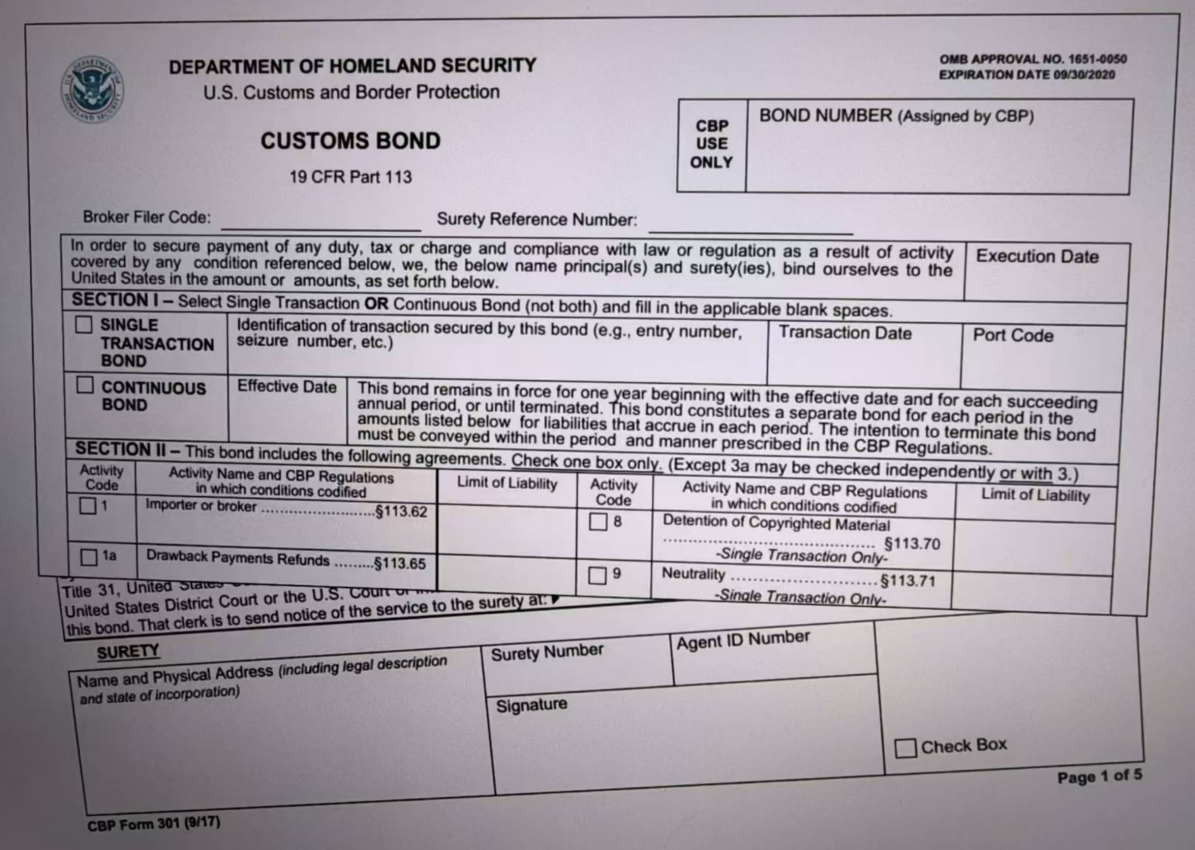

To get a Customs Bond through CUC Freight, you need to fill out a customs bond application in the form of CBP Form 301 and POA. When you utilize the services of CUC, you ensure your bond is correct, complete, and secured. We can handle the behind the scenes work involved in getting the bond for you.

How Fast Can I Get a Customs Bond?

A bond can typically be obtained within 24-48 hours — even faster when we receive your bond application during normal business hours (8am to 5pm ET, M-F).

Learning more about import bond, it may help your importing business a lot.

Customs bond is very critical for entry. When you are shipping goods in-bond, that means your products are moving within the United States, but are still waiting on official customs clearance from Customs before the goods can officially be sold. Freight forwarding or Customs Brokers can help your goods obtain official approval from CBP.

Hiring a freight forwarding like CUC Freight will help you much more on the international shipping.

As an experienced freight forwarder China, CUC Freight has rich experience to handle your shipment. We are welcome to contact us at any times.

Top 10 Chinese Wholesale Sports Jerseys Sites 2025 — With Logistics Advice for ImportersMay 30, 2025The Growing Demand for Sports Jerseys

Sports jerseys have transcended their traditional role as athletic wear to become fashion statements and symbols of team loyalty. With the global sports industry ...view

Top 10 Chinese Wholesale Sports Jerseys Sites 2025 — With Logistics Advice for ImportersMay 30, 2025The Growing Demand for Sports Jerseys

Sports jerseys have transcended their traditional role as athletic wear to become fashion statements and symbols of team loyalty. With the global sports industry ...view Guides For Importing From China To USAJune 27, 2023As an importer in the USA, it is essential to have a reliable and efficient shipping partner in China. Shipping from China to the USA can be a daunting task, especially for beginners. However, with th...view

Guides For Importing From China To USAJune 27, 2023As an importer in the USA, it is essential to have a reliable and efficient shipping partner in China. Shipping from China to the USA can be a daunting task, especially for beginners. However, with th...view Amazon and FedEx Rekindle Partnership to Fill UPS Delivery GapMay 19, 2025After a six-year hiatus, Amazon and FedEx have reunited, sparking buzz in the global logistics industry. With UPS scaling back its partnership with Amazon, FedEx has stepped in to fill the void, rejoi...view

Amazon and FedEx Rekindle Partnership to Fill UPS Delivery GapMay 19, 2025After a six-year hiatus, Amazon and FedEx have reunited, sparking buzz in the global logistics industry. With UPS scaling back its partnership with Amazon, FedEx has stepped in to fill the void, rejoi...view Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view

Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view