After a six-year hiatus, Amazon and FedEx have reunited, sparking buzz in the global logistics industry. With UPS scaling back its partnership with Amazon, FedEx has stepped in to fill the void, rejoining Amazon’s delivery network. This strategic “reconciliation” not only highlights the complex interplay of interests in logistics but also offers valuable insights for e-commerce and supply chain businesses.

A New Chapter for Amazon and FedEx

In late February 2025, Amazon and FedEx signed a multi-year agreement, enabling FedEx to handle residential delivery of select large parcels for Amazon. Industry reports suggest that partnering with FedEx offers Amazon significant cost savings compared to UPS, optimizing its logistics expenses.

An Amazon spokesperson confirmed the deal, stating, “FedEx is now one of our many third-party logistics partners, helping us deliver packages efficiently to our customers.” FedEx, in turn, noted that the agreement followed over a year of negotiations, resulting in a mutually beneficial partnership.

From Fallout to Reunion: A Tale of Interests

The Amazon-FedEx saga has had its share of drama. In 2019, as Amazon aggressively expanded its in-house logistics network, FedEx terminated its delivery contract, viewing Amazon as a competitive threat to its market share. Amazon retaliated by barring third-party sellers from using FedEx for Prime shipments during the holiday season.

Fast forward to 2025, and the tides have turned. The catalyst? UPS’s decision to slash its Amazon shipment volume by over 50% by mid-2026, prioritizing higher-margin business. This created a gap in Amazon’s delivery network, and FedEx seized the opportunity to step back in.

CUC FREIGHT sees this as a classic case of strategic alignment driven by mutual benefit. For U.S. e-commerce businesses, this move underscores the importance of staying agile and choosing logistics partners that align with cost and efficiency goals.

Amazon’s Logistics Dominance: From Client to Industry Leader

Amazon’s rise in logistics is nothing short of remarkable. A decade ago, UPS and FedEx dominated the U.S. market with their robust infrastructure, while Amazon was merely a key client. Since 2014, Amazon has invested heavily in its own warehouses, delivery fleets, and regionalized networks. By 2022, it restructured its U.S. logistics into eight regional hubs, enabling faster, localized deliveries.

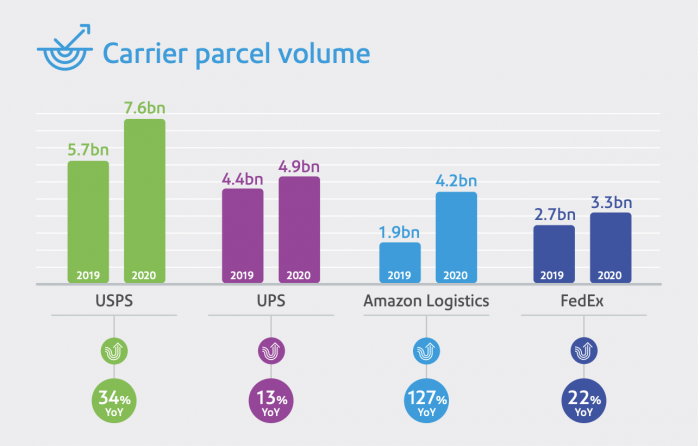

According to Pitney Bowes, Amazon surpassed FedEx in U.S. parcel volume in 2020 (4.2 billion vs. 3.3 billion) and overtook UPS in 2022, becoming the nation’s largest courier. In 2024, Amazon delivered 6.3 billion parcels, a 7.3% increase year-over-year, outpacing UPS (4.7 billion) and FedEx (3.7 billion). Globally, Amazon topped Transport Topics’ Top 50 Global Freight Companies list in 2023 and 2024, ahead of UPS and FedEx.

Yet, Amazon still relies on third-party logistics in regions with limited infrastructure and for reverse logistics. This dependency explains its renewed partnership with FedEx.

Opportunities for U.S. E-Commerce

The Amazon-FedEx partnership offers key takeaways for U.S. e-commerce and logistics stakeholders:

Cost Efficiency Drives Decisions

Amazon’s shift to FedEx highlights the priority of cost optimization. E-commerce businesses should evaluate logistics partners based on affordability without compromising service quality.

Diversified Logistics Networks Are Key

Amazon’s blend of in-house and third-party logistics ensures flexibility. U.S. businesses can adopt a similar approach, partnering with multiple carriers to mitigate risks and enhance reliability.

Reverse Logistics as a Growth Area

Amazon’s weaker reverse logistics capabilities reveal an opportunity. CUCFREIGHT’s tailored return solutions can help e-commerce brands streamline returns, boosting customer satisfaction.

Stay Ahead of Industry Shifts

The Amazon-FedEx deal may reshape U.S. logistics dynamics. Businesses must monitor such trends to adapt their supply chain strategies proactively.

Looking Ahead: The Future of U.S. Logistics

The Amazon-FedEx reunion reflects the ever-evolving nature of logistics, where partnerships are forged and rekindled based on strategic needs. As Amazon continues to expand its logistics empire, traditional giants like FedEx and UPS are redefining their roles. For U.S. e-commerce businesses, navigating this landscape requires smart partnerships and innovative solutions.

CUCFREIGHT, a leader in international logistics, empowers U.S. businesses with cost-effective, reliable supply chain solutions. Whether you’re optimizing delivery costs or enhancing reverse logistics, our customized services help you stay competitive in a dynamic market. Ready to elevate your logistics strategy?

Contact CUC FREIGHT today to explore how we can support your business growth.

Shipping From China

Sources: Business Insider, Retail Dive, Amazon, Pitney Bowes, Transport Topics

The Rise of E-Commerce: Impact on China to USA Courier ServiceApril 9, 2025With the popularization of the Internet and the rapid development of science and technology, e-commerce is booming in the world. As an important player in e-commerce, China's rise has not only cha...view

The Rise of E-Commerce: Impact on China to USA Courier ServiceApril 9, 2025With the popularization of the Internet and the rapid development of science and technology, e-commerce is booming in the world. As an important player in e-commerce, China's rise has not only cha...view Customs ExpertiseMarch 27, 2025In the complex landscape of international shipping, customs clearance stands as a critical juncture that can make or break your logistics operations. At CUC Freight our Customs Expertise is the key to...view

Customs ExpertiseMarch 27, 2025In the complex landscape of international shipping, customs clearance stands as a critical juncture that can make or break your logistics operations. At CUC Freight our Customs Expertise is the key to...view What is Blind ShippingSeptember 1, 2025What Is Blind Shipping?Blind shipping is a logistics practice where the shipper’s identity and address are hidden from the final consignee (the buyer). Instead, the shipment shows the seller’s custo...view

What is Blind ShippingSeptember 1, 2025What Is Blind Shipping?Blind shipping is a logistics practice where the shipper’s identity and address are hidden from the final consignee (the buyer). Instead, the shipment shows the seller’s custo...view What is Expedited FreightSeptember 1, 2025What Is Expedited Freight?Expedited freight is a premium shipping service designed to move goods faster than standard transit times, often with priority handling, fewer stops, and direct routing. It i...view

What is Expedited FreightSeptember 1, 2025What Is Expedited Freight?Expedited freight is a premium shipping service designed to move goods faster than standard transit times, often with priority handling, fewer stops, and direct routing. It i...view