When importing from China, your total landed cost depends heavily on three key variables: tariffs, duties, and taxes. Whether you’re managing regular container loads or specialized freight into regulated markets like the US, UK, EU, or Australia, understanding these charges is essential for budgeting, pricing, and customs compliance.

In this article, we’ll walk you through the mechanics of these fees, highlight key country-specific insights, and share practical tips to help your business reduce risks and stay compliant.

Tariffs are government-imposed taxes on imported goods, usually as a tool for protecting domestic industries or managing trade balances. In many markets, these are product-specific and country-of-origin specific. For example, the U.S. applies Section 301 tariffs on a wide range of Chinese-origin goods.

Duties are calculated based on your product’s HS (Harmonized System) code and the customs-assessed value (most often CIF: Cost + Insurance + Freight). Each product type has its own duty rate, and in many countries, duties are ad valorem (percentage-based).

These include:

Value-Added Tax (VAT) – common in the UK, EU, and China

Goods and Services Tax (GST) – used in countries like Australia, New Zealand, and Canada

Excise Duties – applicable to tobacco, alcohol, and luxury items

Anti-dumping Duties – applicable when a country finds imports are being sold below fair market value

Every product must be classified under the appropriate Harmonized System code. This determines duty rates, import restrictions, and required documentation. Misclassification can result in underpayment penalties or shipment delays.

Tools:

HTSUS (U.S. Schedule)

EU TARIC

Most countries use one of the following pricing bases:

FOB (Free on Board) – price at port of departure

CIF (Cost, Insurance, and Freight) – includes international shipping and insurance costs

DDP (Delivered Duty Paid) – price including all duties and delivery

Multiply the customs value by the applicable duty rate. For example:

If a product has a CIF value of $10,000 and a duty rate of 8%, the duty is:

$10,000 × 8% = $800

Now add taxes on top of the duty-inclusive value. Example (UK VAT @ 20%):

($10,000 + $800) × 20% = $2,160 VAT

Duties: Vary from 0% to over 25%, depending on product and Section 301 lists.

Taxes: No national VAT; state sales tax applies after import.

Key Tip: Use a licensed customs broker for product classification and compliance.

Duties: Based on UK Global Tariff (post-Brexit version of EU CET)

Taxes: 20% VAT on most goods; paid upon import unless using a deferment account

Key Tip: Use Postponed VAT Accounting (PVA) to improve cash flow.

Duties: Apply to non-EU imports; typically 0–12% for industrial goods

Taxes: VAT ranges by country (17–27%)

Key Tip: Declare the correct “Customs Procedure Code (CPC)” for warehouse imports or temporary storage.

Duties: 5% for most goods unless under a Free Trade Agreement

Taxes: 10% GST applies on CIF + duty value

Key Tip: Use FTAs like ChAFTA to reduce or eliminate duties on many Chinese goods.

Trying to reduce duties by undervaluing the shipment is illegal and a red flag for customs audits. Authorities may seize goods or impose heavy fines.

When using EXW, all responsibility falls on the buyer—including inland transport, export clearance, and insurance. Many importers mistakenly assume suppliers will manage customs under EXW.

Use FOB or FCA when working with Chinese suppliers to split responsibility clearly and avoid surprise charges.

Even a small mistake on the commercial invoice, packing list, or Bill of Lading can result in clearance delays. Always ensure:

HS codes are included

Incoterms are clearly stated

Units, quantity, and value match across documents

If sourcing from multiple suppliers, consolidating into one LCL or FCL shipment minimizes the number of customs entries and administrative charges.

Delivered Duty Paid (DDP) shipping allows importers to receive goods with all costs prepaid, including duties and taxes—simplifying compliance for eCommerce and smaller buyers.

Certain U.S. products can apply for Section 301 exclusion. EU and UK regimes sometimes offer temporary suspension of duties under specific customs relief schemes.

Store goods duty-unpaid until they are sold or re-exported. Useful for large-volume traders and international distributors.

Classify Products Correctly

Avoid shortcuts. Always consult a licensed broker or trade compliance team when classifying a new SKU.

Maintain a Centralized Documentation Process

Use digital document platforms and consistent naming conventions to minimize errors.

Build Relationships with Customs Authorities

Apply for Authorized Economic Operator (AEO) status in the EU or Customs-Trade Partnership Against Terrorism (C-TPAT) in the U.S. for faster clearances.

Partner with a Logistics Provider that Knows Your Market

A forwarder with knowledge of both Chinese export procedures and destination country customs can anticipate and resolve delays proactively.

Understanding tariffs, duties, and taxes isn’t just about compliance—it’s about controlling costs, reducing risk, and ensuring reliable delivery timelines. For companies importing from China, these charges can account for 20–35% of the landed cost, depending on the product category and destination market.

At CUC Freight, we work with businesses worldwide to streamline customs procedures, accurately calculate import charges, and integrate compliance into their supply chains. Whether you're shipping a single container or coordinating high-frequency imports, our team ensures every step is optimized and compliant.

Need support with customs classification, DDP pricing, or bonded warehousing? Contact CUC Freight for a tailored solution.

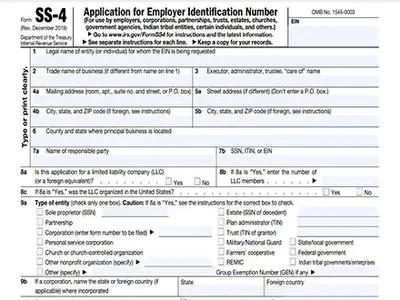

Why do I need an IRS number for importing goods into the US?August 25, 2023When importing into the US, you will be asked for providing an IRS or EIN number for the ultimate consignee. If you have hired a forwarder company to deal with the shipping tasks, experienced forwarde...view

Why do I need an IRS number for importing goods into the US?August 25, 2023When importing into the US, you will be asked for providing an IRS or EIN number for the ultimate consignee. If you have hired a forwarder company to deal with the shipping tasks, experienced forwarde...view What is FCL Shipping? A Complete GuideApril 21, 2024Introduction to FCL ShippingIn the realm of international trade, FCL shipping stands as a pillar supporting the seamless movement of goods across borders. FCL, or Full Container Load, is a shipping me...view

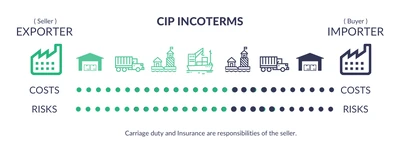

What is FCL Shipping? A Complete GuideApril 21, 2024Introduction to FCL ShippingIn the realm of international trade, FCL shipping stands as a pillar supporting the seamless movement of goods across borders. FCL, or Full Container Load, is a shipping me...view Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view

Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view Top 10 Chinese Wholesale Sports Jerseys Sites 2025 — With Logistics Advice for ImportersMay 30, 2025The Growing Demand for Sports Jerseys

Sports jerseys have transcended their traditional role as athletic wear to become fashion statements and symbols of team loyalty. With the global sports industry ...view

Top 10 Chinese Wholesale Sports Jerseys Sites 2025 — With Logistics Advice for ImportersMay 30, 2025The Growing Demand for Sports Jerseys

Sports jerseys have transcended their traditional role as athletic wear to become fashion statements and symbols of team loyalty. With the global sports industry ...view