The Geneva skyline buzzed with cautious optimism on May 12, 2025, as Chinese and U.S. negotiators emerged from marathon talks with a joint statement that could hit the reset button on their bruising trade war. With U.S. tariffs on Chinese goods once peaking at a staggering 145% and China’s counter-tariffs climbing to 125%, this deal—slashing tariffs and opening new dialogue—feels like a lifeline for businesses battered by uncertainty. At CUC Freight, we’ve been glued to the developments, and we’re breaking down what this means for your supply chain, from electronics to agriculture, and how we’re gearing up to help you thrive.

But the real headline is the new dialogue pipeline. Vice Premier He Lifeng will lead China’s team, while U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer helm the American side. They’ll meet in rotating venues—Beijing, Washington, or a neutral spot like Singapore—with staffers diving into nitty-gritty issues like tech transfers and farm exports. “This isn’t just a ceasefire; it’s a chance to rebuild trust,” He reportedly told reporters in Geneva, per The Wall Street Journal.

.jpg)

As of May 14, 2025, U.S. tariffs on Chinese goods average 50.8%, comprising a 20.8% Section 301 tariff, a 20% fentanyl tariff, and a 10% reciprocal tariff (after suspending 24% of the 34% reciprocal tariff for 90 days and canceling a 91% reciprocal tariff increase). The suspension, part of the China-U.S. Geneva joint statement, expires August 11, 2025, potentially raising the reciprocal tariff to 34% if talks fail.

| Project/Product | Steels | Electronicproducts3C | Toy | Clothing | SmallappliancesHEA |

| Base Tariff Rate | 0–5% | 0–10% | 0% | 0–10% | 0% |

| 301(2018Launch) Duty | 25% | 0% | 0% | 25% | 25% |

| Fentanyl Tariff(onChina) | 20% | 20% | 20% | 20% | 20% |

| From May 14 | 0% | 0% | 10% | 10% | 10% |

| Additional Tariffon SteelProducts | 25% | 0% | 0% | 0% | 0% |

| TotalDutyRate (90Days) | 70% | 30% | 30% | 60% | 55% |

Still, that lingering 10% tariff and the temporary truce keep everyone on edge. “It’s progress, not a cure,” says Ma.

At CUC Freight, we’re not just tracking headlines—we’re moving cargo through the chaos. Last week, we rerouted a client’s apparel shipment from Shenzhen to Los Angeles via a tariff-optimized port, shaving 12% off their costs. Here’s how we’re stepping up:

Take our recent win: a California electronics firm leaned on us to streamline their China imports. By tweaking their logistics, we cut transit times by three days and costs by 18%. Want similar results? Hit us up at info@cucfreight.com (mailto:CUC).

As a U.S. negotiator told NPR outside the Geneva talks, “We’re not solving everything, but we’re finally talking.” For businesses, that’s a signal to act fast and plan smart.

Sources: China-US Joint Statement, May 12, 2025; The Wall Street Journal, Bloomberg, Reuters, CNBC, Financial Times, NPR

What Is the Alameda Corridor Surcharge (ACS)?November 24, 2025The Alameda Corridor Surcharge (ACS) is a fee applied to containerized cargo moving through the ports of Los Angeles and Long Beach in California. It covers the cost of using the Alameda Corridor, a 2...view

What Is the Alameda Corridor Surcharge (ACS)?November 24, 2025The Alameda Corridor Surcharge (ACS) is a fee applied to containerized cargo moving through the ports of Los Angeles and Long Beach in California. It covers the cost of using the Alameda Corridor, a 2...view US-UK Tariff Reduction Agreement: How to Optimize Your China to USA/UK Shipping in 2025May 8, 2025The global trade landscape is shifting, and businesses importing from China to the USA and UK are poised to benefit. On May 8, 2025, the United States and the United Kingdom are expected to announce a...view

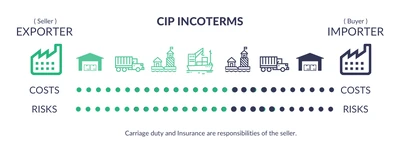

US-UK Tariff Reduction Agreement: How to Optimize Your China to USA/UK Shipping in 2025May 8, 2025The global trade landscape is shifting, and businesses importing from China to the USA and UK are poised to benefit. On May 8, 2025, the United States and the United Kingdom are expected to announce a...view Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view

Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view Latest U.S. Tariff Increases: Freight Carrier Responses & Market Shifts (Updated April 2025)April 27, 2024I. Carriers Expanding or Prioritizing U.S. RoutesEnhanced U.S. West Coast ServicesPriority Customs Clearance: Select logistics providers now offer expedited customs clearance for U.S.-bound shipments,...view

Latest U.S. Tariff Increases: Freight Carrier Responses & Market Shifts (Updated April 2025)April 27, 2024I. Carriers Expanding or Prioritizing U.S. RoutesEnhanced U.S. West Coast ServicesPriority Customs Clearance: Select logistics providers now offer expedited customs clearance for U.S.-bound shipments,...view