Blind shipping is a logistics practice where the shipper’s identity and address are hidden from the final consignee (the buyer). Instead, the shipment shows the seller’s customer or distributor as the shipper of record, creating the impression that the goods are coming directly from them rather than the original supplier or manufacturer.

This strategy is widely used in dropshipping, distribution, and wholesale supply chains.

Supplier ships goods directly to the end customer.

The shipping documents and labels do not display the supplier’s details.

Instead, the buyer’s name, warehouse, or distributor is shown as the shipper of record.

Often, freight forwarders or 3PLs (third-party logistics providers) facilitate blind shipping by generating neutral documents (bills of lading, invoices) and controlling the flow of information.

Protect Supplier Information

Prevents the end customer from bypassing distributors and going straight to the source.

Branding Control

Ensures that only the distributor’s or reseller’s brand is visible on the shipment.

Streamlined Supply Chains

Goods move directly from the factory to the customer without stopping at the distributor’s warehouse.

Drop Shipping: Retailer never handles inventory; the supplier ships directly to the customer, often branded under the retailer’s name.

Blind Shipping: Focuses on hiding the true shipper’s identity while allowing distributors or resellers to maintain customer loyalty.

Documentation Errors: If blind bills of lading are mishandled, customs authorities may flag shipments.

Trust Issues: Requires strong relationships between suppliers, freight forwarders, and distributors.

Compliance: Must still meet customs and legal requirements even when disguising shipper details.

Blind shipping is a valuable logistics tool for businesses that want to protect their supply chain relationships and brand identity while still leveraging direct shipments from China (or other origins) to global customers.

Shipping warning! U.S. Customs strictly inspects these goods, making these goods the hardest hit areaApril 27, 2024Since April, the U.S. customs inspection rate has surged. This change has aroused deep concern among international traders.What causes the customs inspection rate to soar? It is understood that the im...view

Shipping warning! U.S. Customs strictly inspects these goods, making these goods the hardest hit areaApril 27, 2024Since April, the U.S. customs inspection rate has surged. This change has aroused deep concern among international traders.What causes the customs inspection rate to soar? It is understood that the im...view Amazon Europe FBA 2025 Fee Changes: Return Fee Exemption & How CUC Logistics Maximises Seller SavingsMay 6, 2025Global Trade Shifts & European OpportunitiesWhile U.S. trade policies reshape global commerce, savvy businesses are diversifying into Europe’s €470 billion e-commerce market. Amazon Europe’s 20...view

Amazon Europe FBA 2025 Fee Changes: Return Fee Exemption & How CUC Logistics Maximises Seller SavingsMay 6, 2025Global Trade Shifts & European OpportunitiesWhile U.S. trade policies reshape global commerce, savvy businesses are diversifying into Europe’s €470 billion e-commerce market. Amazon Europe’s 20...view Trump Tariff Overhaul Reshapes Global Logistics: Cross-Border E-commerce & Air Freight Face Seismic ShiftsNovember 13, 2023How evolving Sino-US trade policies impact courier China to UK services, air freight from China to UK routes, and global shipping costsview

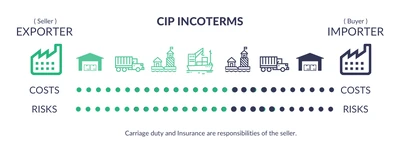

Trump Tariff Overhaul Reshapes Global Logistics: Cross-Border E-commerce & Air Freight Face Seismic ShiftsNovember 13, 2023How evolving Sino-US trade policies impact courier China to UK services, air freight from China to UK routes, and global shipping costsview Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view

Understanding the CIP Incoterm: Carriage and Insurance Paid toMay 30, 2025The CIP (Carriage and Insurance Paid To) Incoterm is one of the 11 internationally recognized trade terms defined by the International Chamber of Commerce (ICC). It outlines the responsibilities of bu...view